SafetyWing Travel Insurance Review: Pricing, Coverage, And Benefits For Travelers

SafetyWing travel insurance is a popular choice for travelers, digital nomads and remote workers who want affordable and flexible international health insurance.

It offers worldwide coverage, simple online signup, and plans that can be started and stopped when you need them.

This makes it easy to stay protected while moving between countries without a long-term contract or complicated paperwork.

Below is a quick overview of the main features.

- Monthly premium from $56.28

(ages 18–39, excluding the United States) - Flexible policy length starting from 5 days

(5-day plan costs $10.05 without U.S. coverage) - No waiting period, even if you join while already abroad

- 24-hour live chat support

- Coverage for flight delays and lost baggage

- Simple online quote and easy application process

The basic plan is cost-effective compared to many other international health insurance providers, especially for younger travelers who do not need U.S. coverage.

If you add coverage for the United States, the premium increases but still remains reasonable for the level of protection offered.

In addition to medical coverage, SafetyWing also protects you against common travel problems such as trip interruptions, lost luggage, and travel delays.

In this article, we will explain SafetyWing’s coverage in detail and walk you through how to sign up step by step, including screenshots of the application process.

Easily check your insurance cost based on your travel plan!

What is SafetyWing?

SafetyWing is an international insurance provider based in San Francisco, USA.

It offers flexible health and travel insurance designed specifically for digital nomads, remote workers, and frequent travelers.

The company focuses on providing affordable, easy-to-manage, and globally accessible insurance plans.

With simple online enrollment and flexible policy options, SafetyWing makes it easy for travelers to stay protected anywhere in the world.

SafetyWing’s Plans

SafetyWing offers two insurance plans: Essential and Complete.

For most travelers, the Essential Plan is usually enough.

SafetyWing Essential

- Monthly cost starts at $56.28 for ages 10–39 (excluding U.S. coverage)

- Medical emergency coverage up to $250,000

- Travel protection for lost luggage, flight delays, and trip interruptions

- Optional add-ons for adventure sports and electronics protection

The Essential Plan is designed for individual travelers who need reliable medical and travel protection while moving between countries.

It covers emergencies, unexpected travel issues, and short-term trips without requiring long-term healthcare coverage.

SafetyWing Complete

- Ideal for companies with remote or globally distributed teams

- Includes routine check-ups and preventive care

- Flexible enrollment for employees in multiple countries

- Offers full global health insurance similar to traditional medical plans

The Complete Plan is a comprehensive global health insurance option suitable for companies, families, or individuals who need routine healthcare in addition to emergency coverage.

It provides broader protection than the Essential Plan and is designed for long-term international living.

SafetyWing’s Pricing Structure

The insurance premium varies depending on your age and whether your trip includes the United States. For more information, please refer to the table below.

| Excluding the USA | Including the USA | |

|---|---|---|

| 10-39 years | $56.28 | $104.44 |

| 40-49 years | $92.40 | $171.92 |

| 50-59 years | $145.04 | $282.80 |

| 60-69 years | $196.84 | $386.12 |

If you are traveling with a child under the age of 10, one child per adult can be covered for free. However, each family can receive free coverage for up to two children in total.

You can also add extra coverage for adventure sports and theft of electronic devices, each for an additional $10.

Extra Coverage: Adventure Sports

By adding coverage for adventure sports, you will be covered up to $100,000 in case of an accident.

American football, Australian football, aviation, bobsleigh, boxing, cave diving, freestyle skiing, hang gliding, high diving, ice hockey, karting, kitesurfing, martial arts, luge, motorcycles, motorized dirt bikes, mountaineering below 6,000 meters, parachuting, parasailing, paragliding, quad biking, rugby, ski/snowboard jumping, ski flying, ski/snowboard acrobatics, skydiving, skeleton, snowmobiling, caving, scuba diving with PADI/NAUI/SSI/BSAC certified instructors, tandem skydiving, white-water rafting, wrestling.

However, professional sports, organized sports, and sports with financial rewards are not covered.

Extra Coverage: Theft of Electronic Devices

By adding electronic device theft coverage, you will be insured for up to $1,000 per item if devices such as laptops are stolen. The maximum coverage limit is $3,000 per year for each insurance contract.

Laptops, cameras, lenses, smartphones, e-readers, music players, tablets, earphones, headphones, iPads, AirPods, and drones.

Note: When filing a claim for stolen electronic devices, you must provide proof that:

- The theft was reported to the police within 24 hours of the incident.

- The electronic device was in your possession before the theft occurred.

» Visit the official SafeyWing website

SafetyWing’s Coverage Overview

The maximum medical coverage provided by SafetyWing is $250,000. Within this limit, you are covered for the following medical services and benefits:

| Insurance Details | Insurance Limit |

|---|---|

| Medical Insurance | $250,000 |

| Emergency Dental Care | $1,000 |

| Emergency Transportation | $100,000 |

| Medical repatriation | $5,000 |

| Emergency return to your country | $5,000 |

| Lost Baggage | $3,000 |

| Flight delays | $200 |

| Theft of passports | $100 |

| Car Accident | $250,000 |

| Interruption of travel (return to your country) | $250,000 |

| At the time of death | $20,000 |

SafetyWing is highly popular among digital nomads because it offers flexible plans, affordable pricing, and well-balanced coverage that fits the needs of a mobile lifestyle.

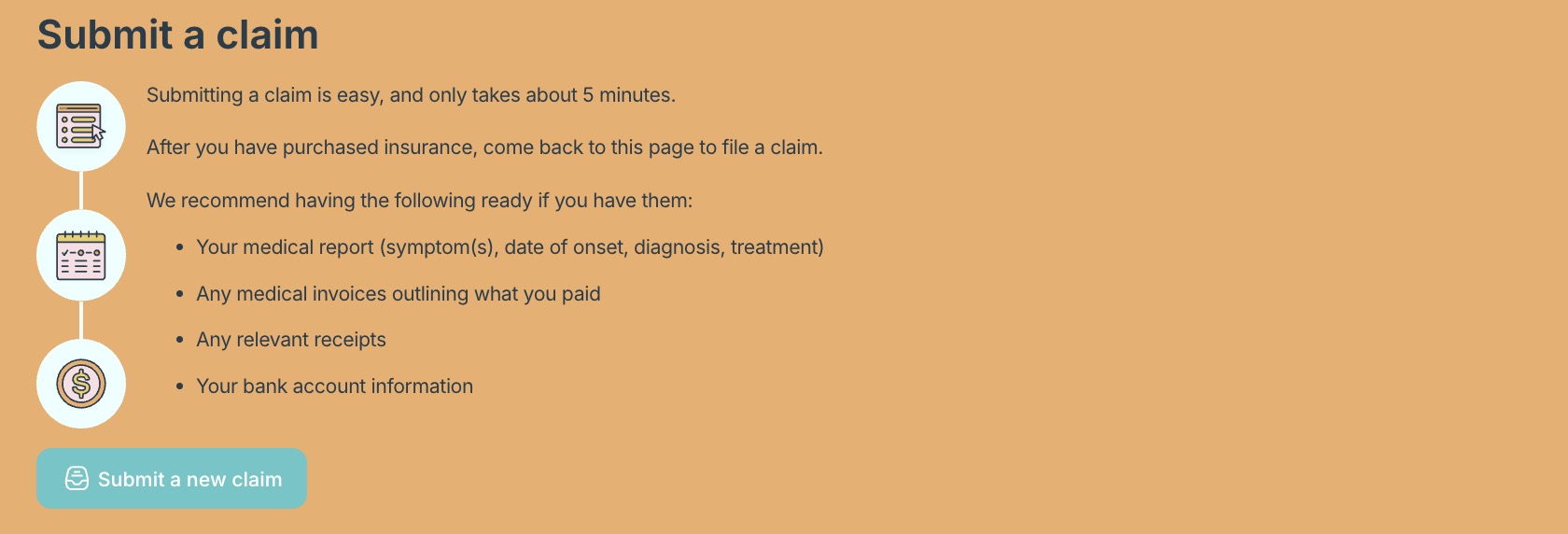

How to Make an Insurance Claim in an Emergency

If you visit a hospital due to an illness or injury, you can submit an insurance claim within 60 days after your policy ends.

In most cases, you do not need to contact SafetyWing in advance. You simply pay for the medical treatment at the hospital and submit your claim afterward.

However, if you require emergency transportation to a hospital with better facilities, you must contact SafetyWing beforehand so they can arrange the appropriate medical transport.

You can submit your insurance claim through the mobile app or a web browser. When filing a claim, please prepare the following documents:

- Your medical certificate

- Invoices for the medical expenses you paid

- Receipts related to the treatment

- Your bank account information

To submit your claim, upload the required documents through the official claim page and complete the application process.

SafetyWing Nomad Insurance Reviews

Is SafetyWing a reliable insurance provider for digital nomads and long-term travelers?

We reviewed multiple SafetyWing customer reviews and official information online and summarized the most important points below.

Positive Reviews

✔ Affordable Pricing – Many users highlight that SafetyWing offers some of the most budget-friendly travel insurance options, starting at $56.28 per month.

✔ Flexible Enrollment – Travelers appreciate the ability to purchase or extend coverage while already abroad, unlike traditional insurance plans that require enrollment before departure.

✔ Global Coverage – SafetyWing provides worldwide coverage, including emergency medical care, travel disruptions, and optional add-ons like adventure sports and electronics theft protection.

✔ Easy Claims Process – Some users report smooth reimbursement experiences, especially for minor medical expenses and travel-related claims.

✔ 24/7 Support – The availability of live chat and customer support is a key advantage for nomads who may need assistance in different time zones.

SafetyWing receives praise for its affordability, flexibility, and ease of use, making it a preferred choice for digital nomads and frequent travelers.

Negative Reviews

✘ Limited Coverage for Chronic Conditions – SafetyWing does not cover treatment for pre-existing or chronic illnesses, which some users find restrictive.

✘ High Deductible – The $250 deductible per claim can be a drawback for those who need frequent medical care, as small expenses might not be reimbursed.

✘ Delays in Claims Processing – Some users report slow claim approvals and challenges in receiving payouts, particularly for more complex cases.

✘ U.S. Coverage Limitations – Even with U.S. coverage, users must pay a $100 copay for emergency room visits and $50 for urgent care, which adds to out-of-pocket costs.

✘ Electronics Theft Claims Require Strict Proof – To claim compensation for stolen electronics, users must provide a police report within 24 hours and proof of prior ownership, which can be difficult in some cases.

While SafetyWing is widely used, some travelers have expressed concerns about certain aspects of the service.

Our Insights on SafetyWing Insurance Reviews

SafetyWing Nomad Insurance is a strong option for travelers who need affordable, flexible, and globally accessible coverage.

It works well for those seeking emergency medical protection and basic travel benefits, though it may not be suitable for people who require long-term healthcare or frequent claim processing.

✔ Digital nomads, remote workers, and frequent travelers.

✔ Anyone who wants flexible, month-to-month insurance.

✔ Travelers who need emergency medical care and travel protection.

✘ Individuals with chronic conditions requiring regular treatment.

✘ People who prefer low deductibles for small medical expenses.

✘ Travelers who expect immediate reimbursement for claims.

Overall, SafetyWing is popular for its competitive pricing and wide-ranging coverage.

However, travelers should carefully check the policy details to ensure it fits their personal needs and travel style.

Easily check your insurance cost based on your travel plan!

SafetyWing vs World Nomads, Heymondo, Genki

When comparing travel insurance providers, SafetyWing stands out for its affordability and balanced coverage.

Below is a comparison between SafetyWing and other popular providers such as Heymondo, World Nomads, and Genki.

Pricing & Flexibility

- SafetyWing

: Most affordable at $56.28/month, with a minimum enrollment of just 5 days, offering excellent flexibility. - World Nomads

: The most expensive at $220.43/month, but includes extensive travel and medical benefits. - Heymondo

: Starts at $113.05/month, nearly double the price of SafetyWing. - Genki

: At €48.30/month, it is cost-effective but does not include travel-related protections such as baggage or flight coverage.

Medical Coverage

- SafetyWing

: Provides up to $250,000 in medical coverage per policy period. - World Nomads & Heymondo

: Offer $5 million or more, ideal for travelers who want higher medical limits. - Genki

i: Offers unlimited medical coverage, but excludes travel-related protections.

Travel Protections

- SafetyWing

: Covers lost baggage (up to $3,000), flight delays ($200 for delays over 12 hours), and emergency medical transport (up to $100,000). - World Nomads & Heymondo

: Offer higher limits for baggage protection and trip interruption, but at a higher price. - Genki

: Does not cover baggage loss, flight delays, or travel interruptions.

Important Considerations When Joining SafetyWing

Before choosing SafetyWing for your travel insurance, it’s important to understand its limitations and policy conditions.

While SafetyWing is popular for its affordability and global flexibility, being aware of these restrictions will help you decide whether it truly fits your travel needs.

- Limited Coverage for Chronic Illnesses

: SafetyWing does not cover long-term or chronic conditions such as cancer or ongoing medical treatments. - U.S. Co-Pay Requirements

: Even with U.S. coverage, you must pay a $100 co-pay for each emergency room visit and $50 for urgent care. - No Coverage for Professional or High-Risk Sports

: Optional adventure sports coverage is available, but professional or organized competitive sports are excluded. - Strict Conditions for Theft Claims

: Electronic device theft is covered only if you report the incident to the police within 24 hours and provide proof of ownership. - Mandatory Pre-Authorization for Hospitalization

: If you require hospital admission, you must inform SafetyWing before discharge to ensure coverage. - Age Restrictions

: SafetyWing is not available for individuals over 70 years old. - Claims Deadline

: All claims must be submitted within 60 days after your policy ends.

Considering these points, evaluate whether SafetyWing provides sufficient coverage for your situation.

In some cases, you may need additional insurance for gaps such as lost baggage, trip cancellations, or personal liability.

How to Purchase SafetyWing Insurance?

In this section, we will explain how to purchase SafetyWing insurance, complete with screenshots to guide you through each step.

When you click the link to the official SafetyWing website, the following screen will appear.

Next, click “Sign me up” located under the monthly fee of $56.28. You can customize your insurance period after signing up.

Enter your email address and password in the form below to log in. You can also sign in using a Google account.

Next, fill out the form by entering your full name and date of birth.

Next, select your country and nationality of your citizenship.

Next, enter your address. You can fill in your postal code in the field below or enter your full address manually.

Once your address is registered, your account setup is complete.

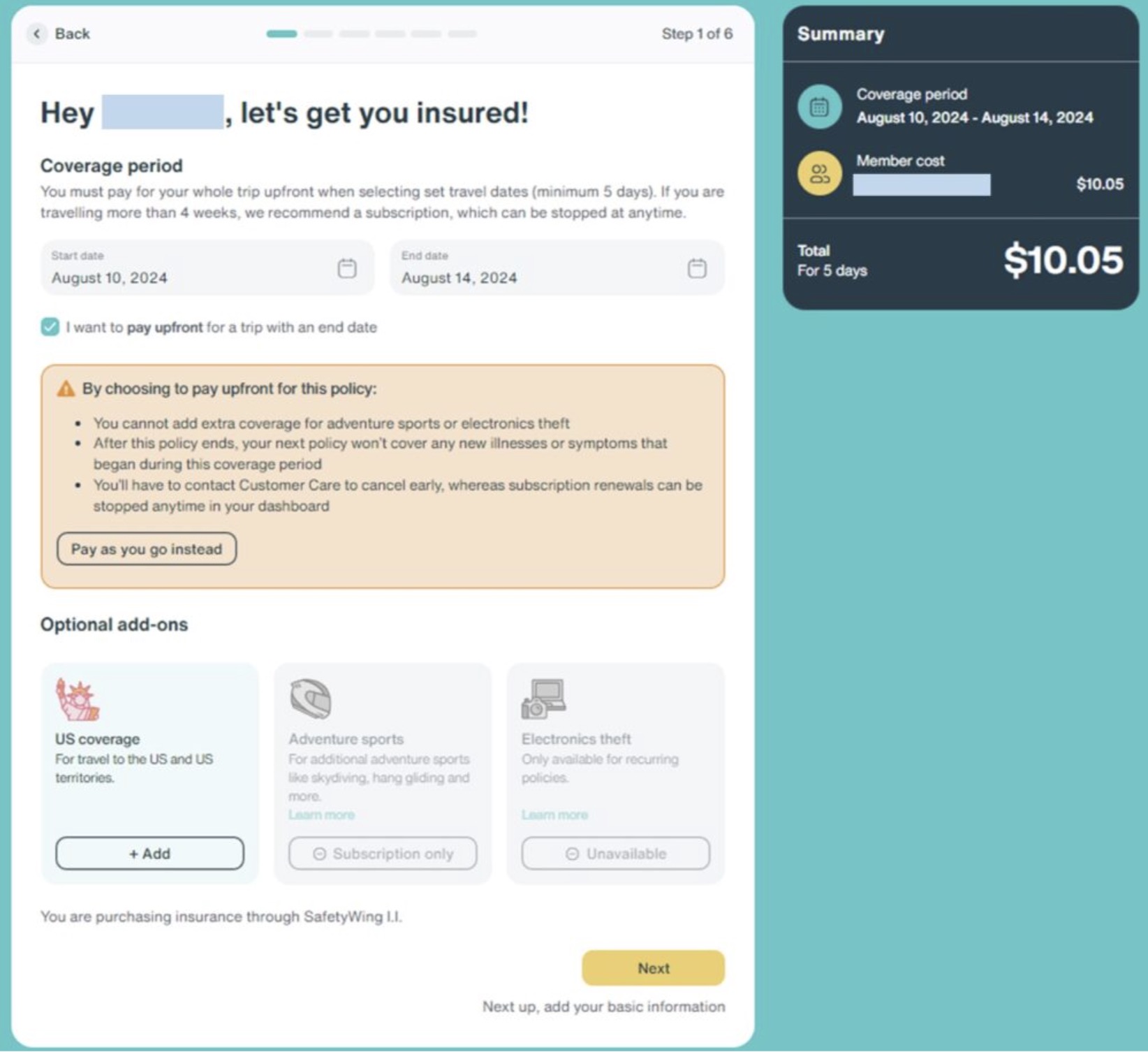

Next, choose your insurance plan.

If you prefer to customize your policy period based on your travel dates—rather than using the standard monthly plan of $56.28 per month—check the box labeled “I want to pay upfront for a trip with an end date.”

After selecting this option, fields will appear where you can enter your insurance start date and end date, as shown below.

As shown in the screenshot above, the insurance fee for your selected coverage period will appear on the right side of the screen.

After confirming the price, click “Next.”

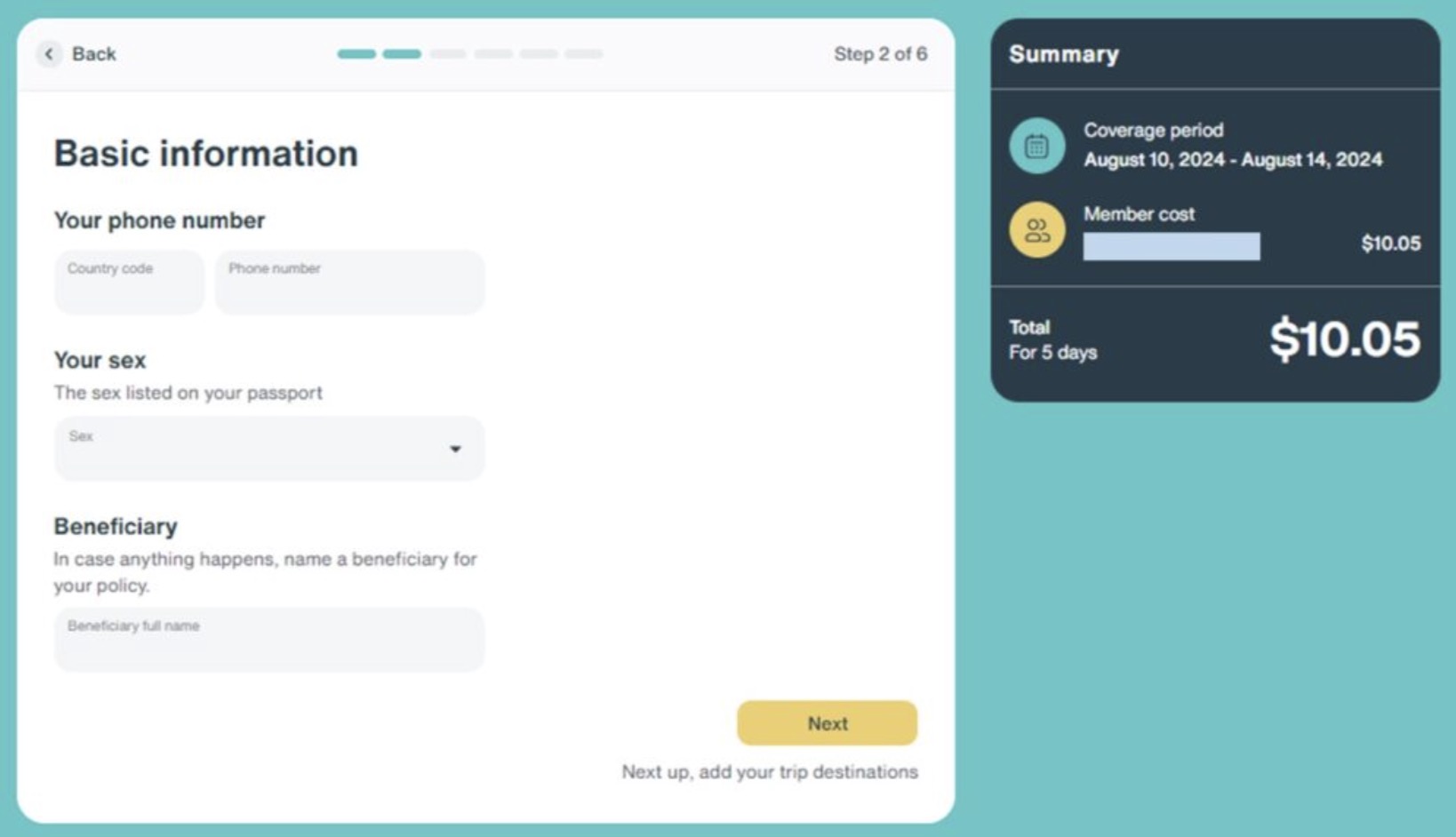

On the following page, enter your phone number, gender, and the name of your beneficiary—the person who would receive the insurance benefits in the unlikely event of a serious accident or death.

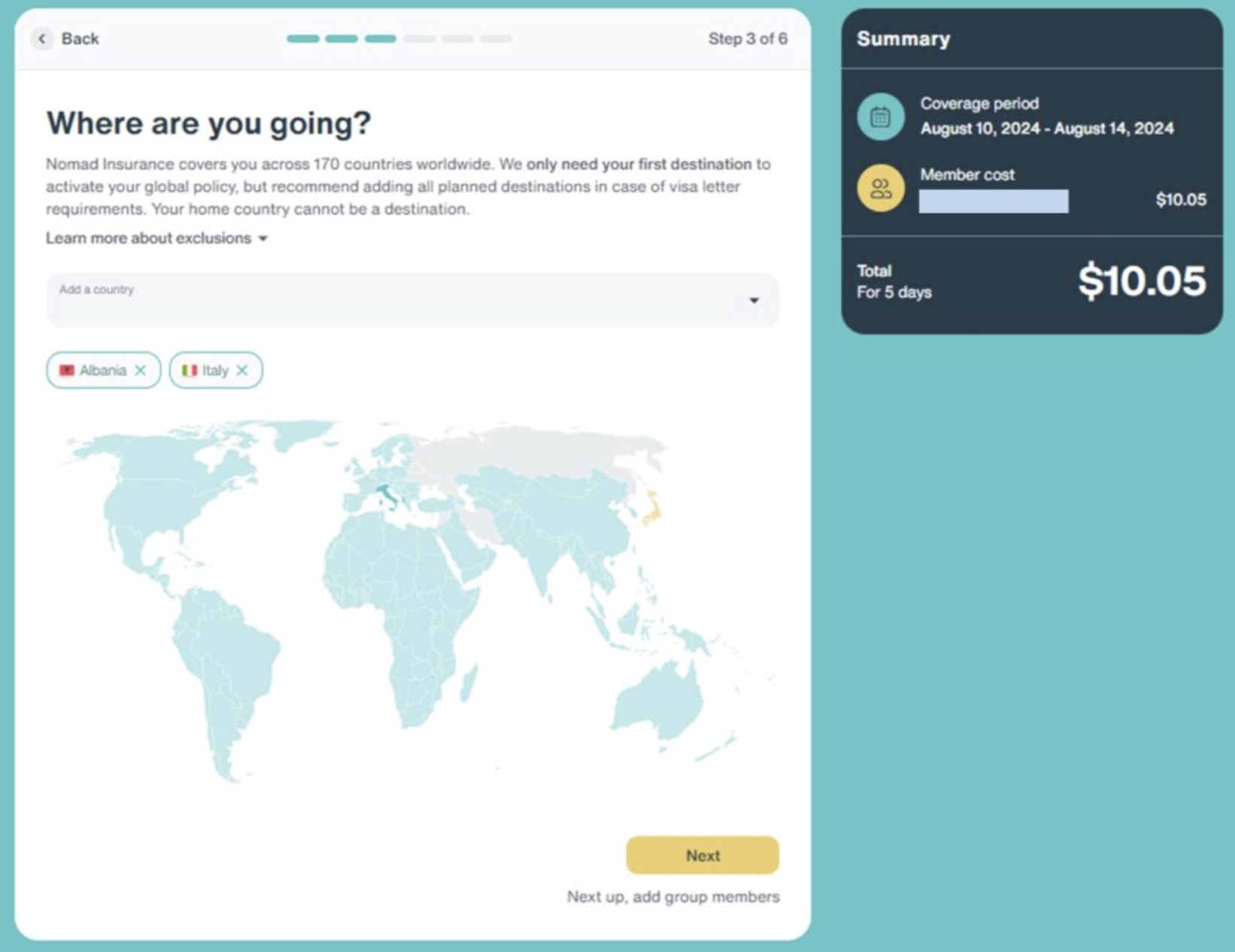

Next, select the destination country or countries where you want the insurance to apply.

If you will be traveling through multiple countries, be sure to include all destinations you plan to visit or transit through.

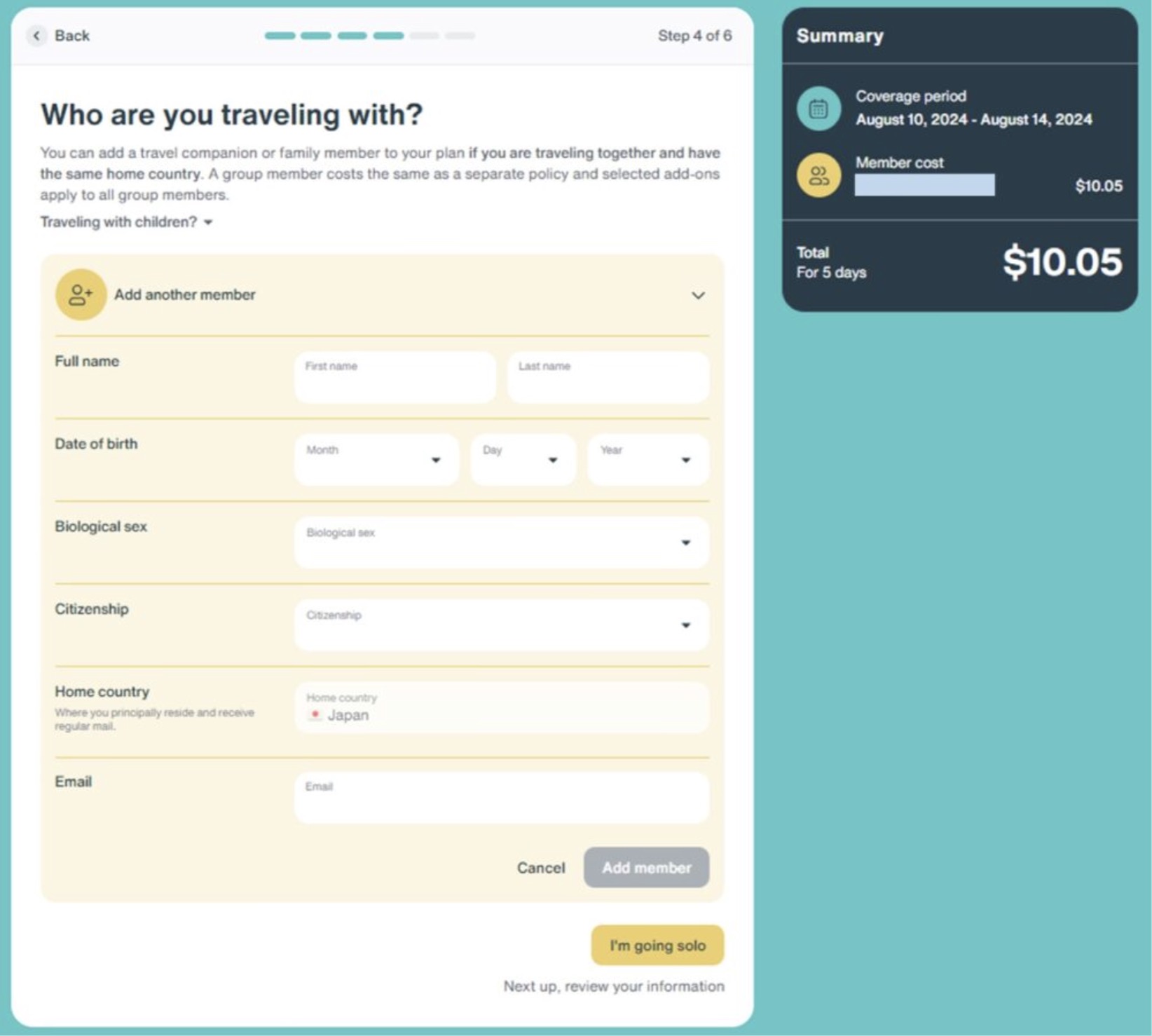

Next, if you are traveling with someone, add your companion by filling out the form below.

If you are traveling alone, simply tap “I’m going solo.”

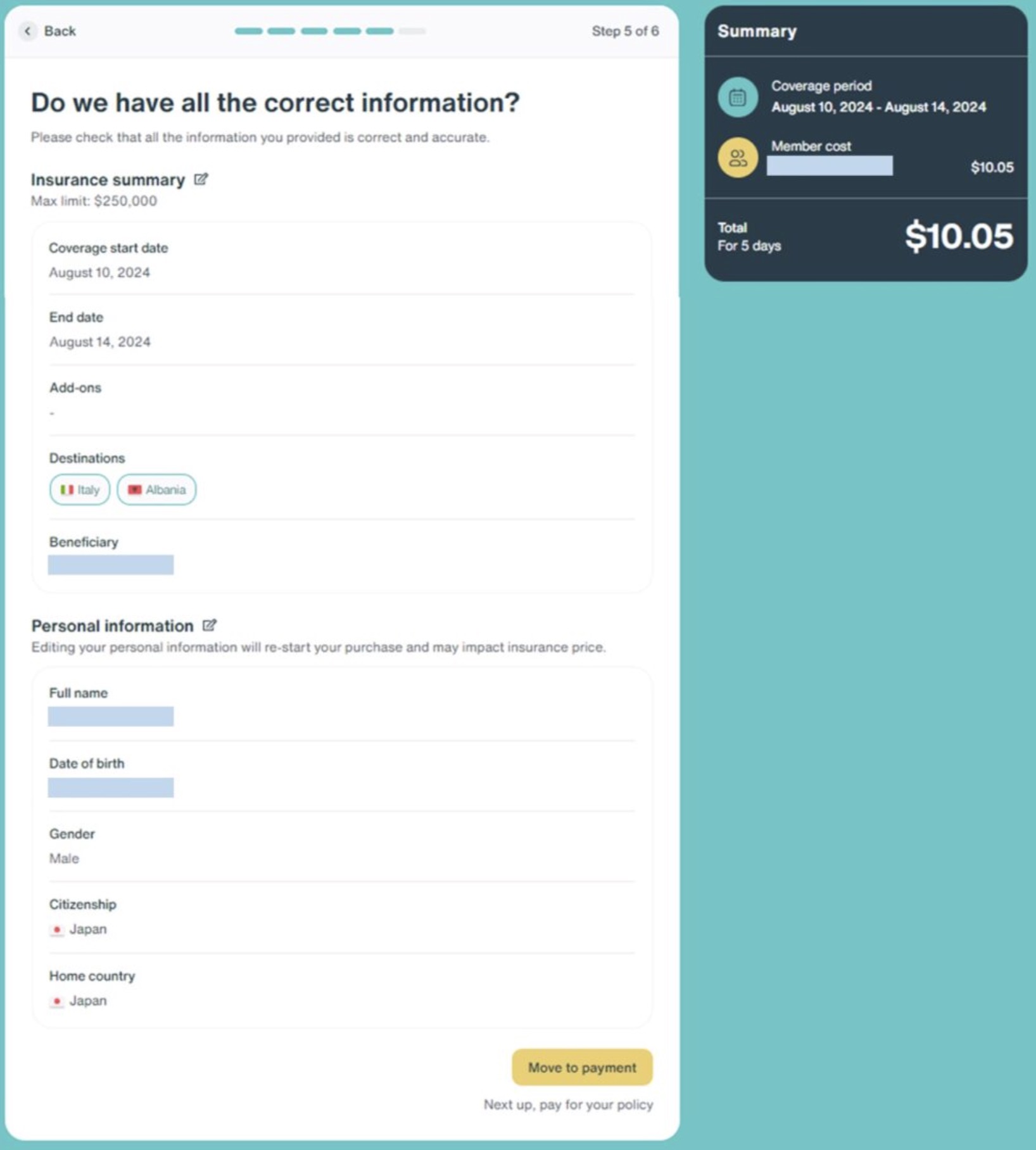

Review your application details below. If everything is correct, tap “Move to payment.”

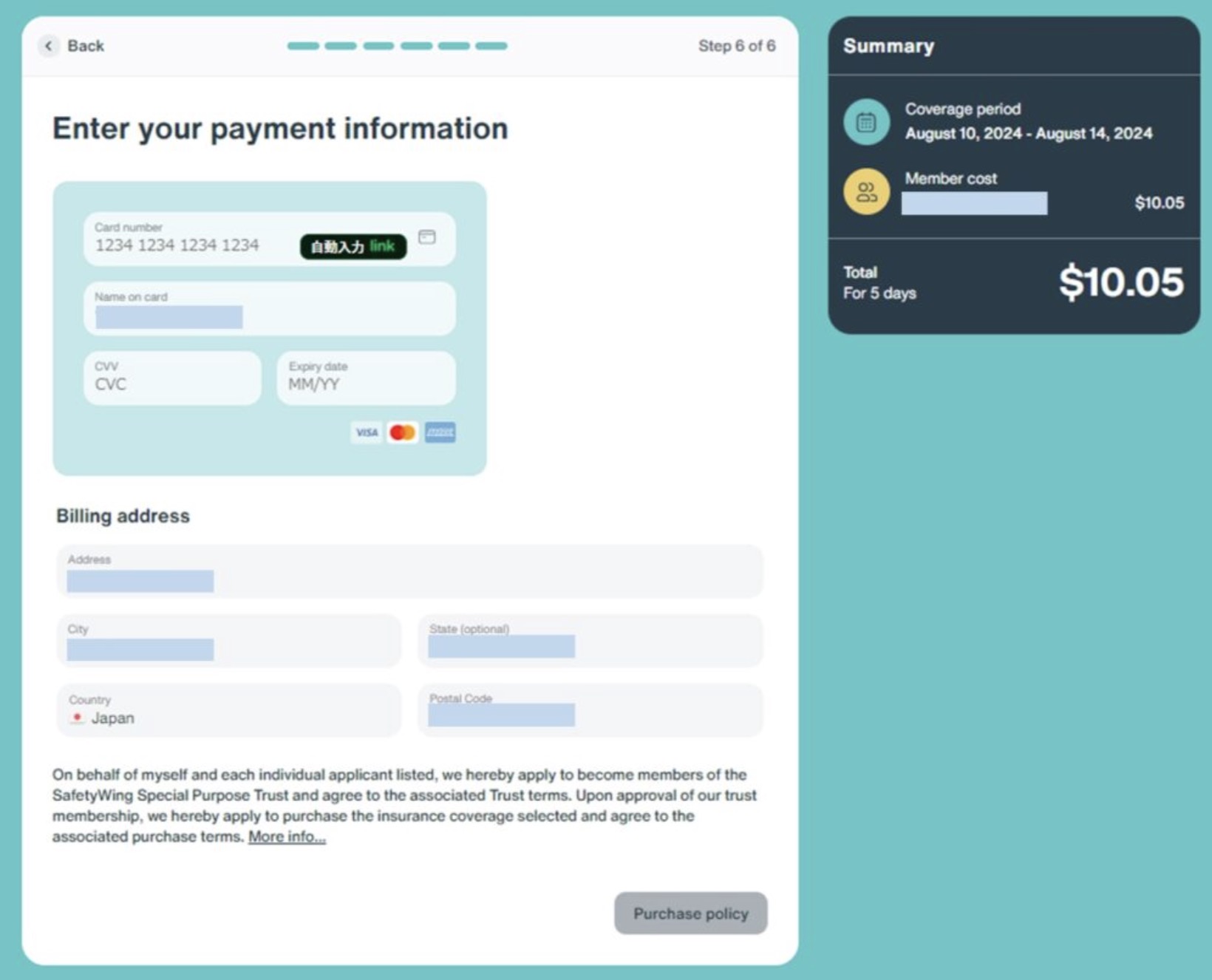

Finally, enter your credit card details and billing information.

This completes the process of purchasing your SafetyWing insurance.

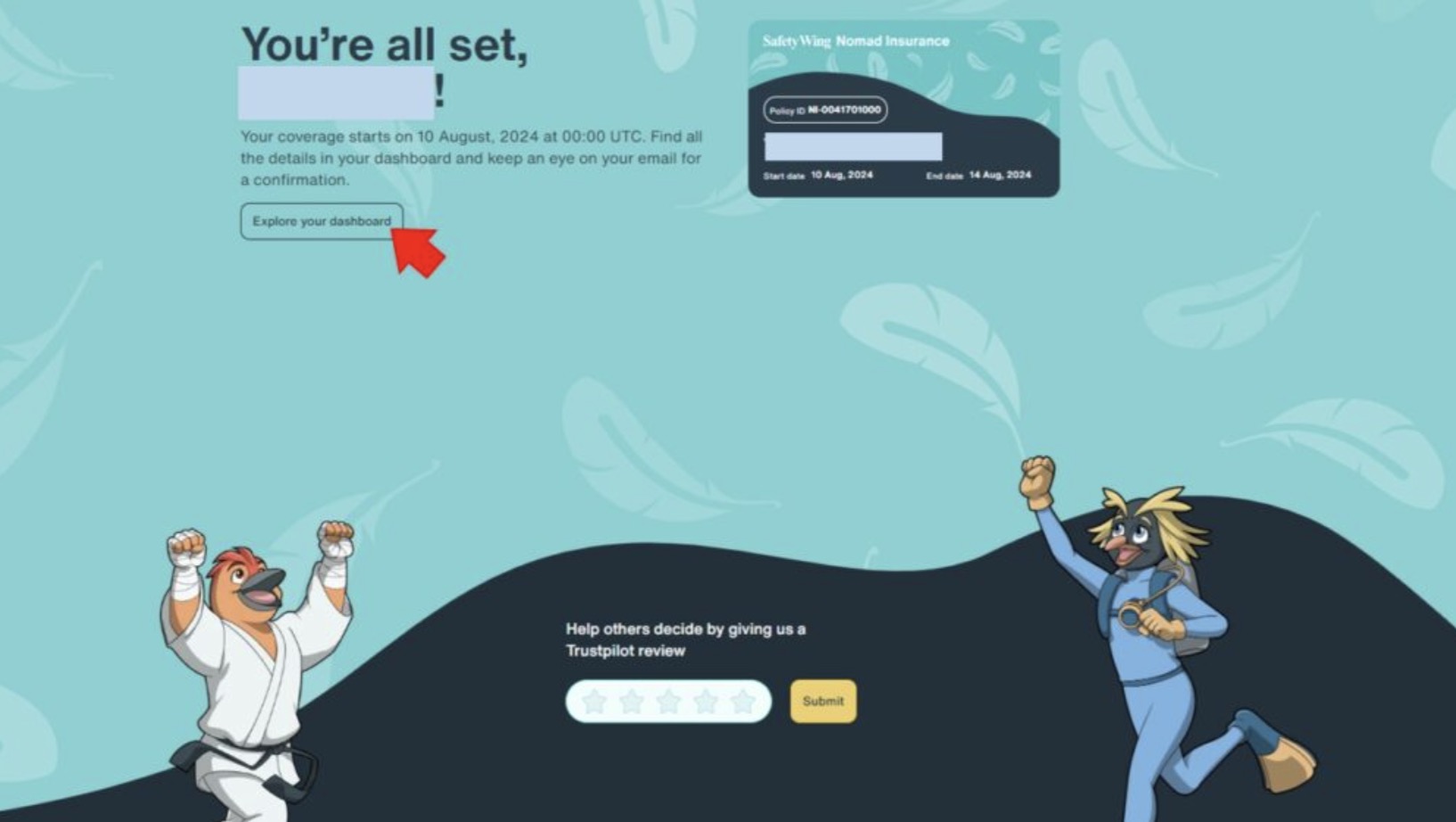

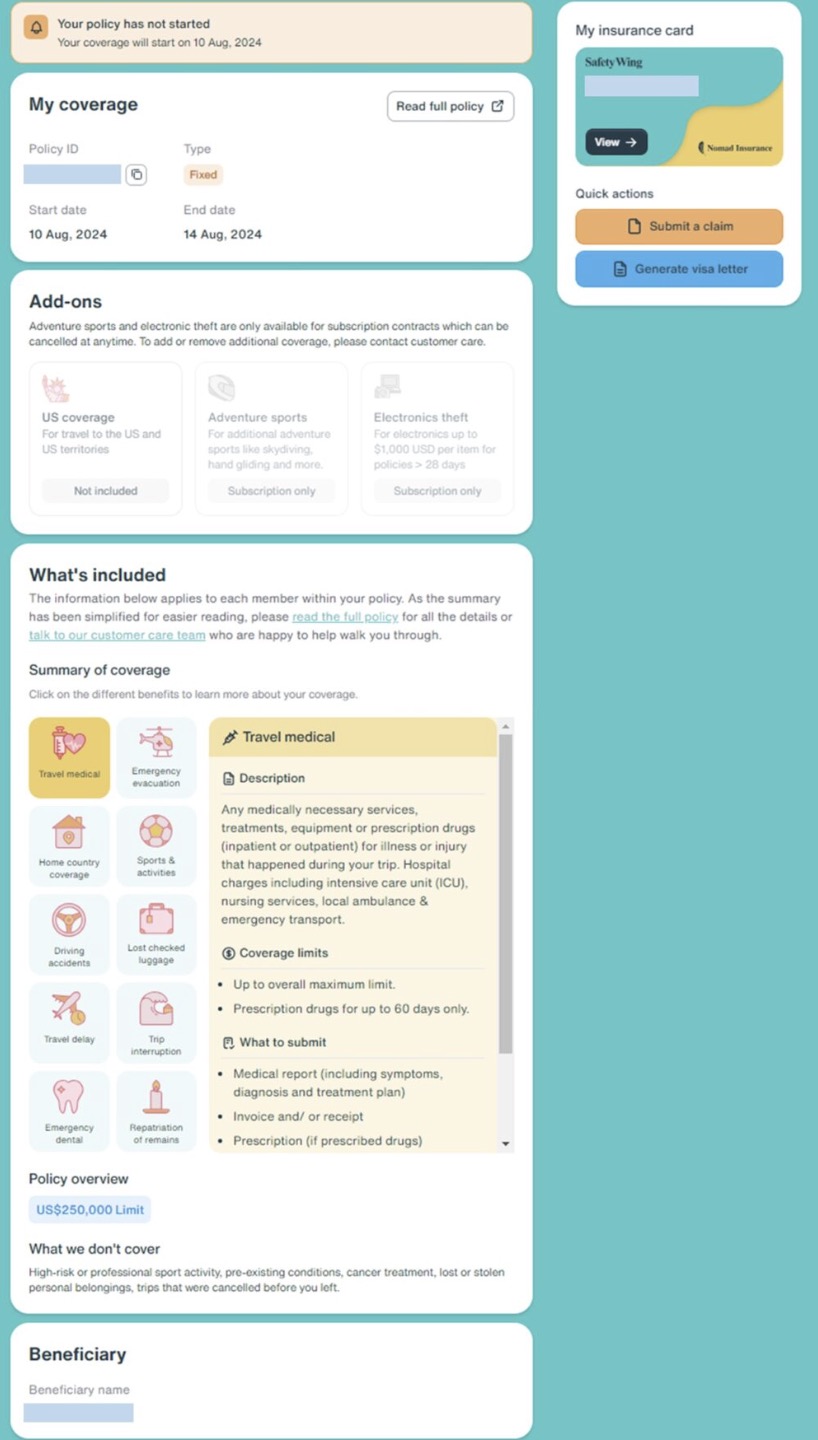

Next, go to your Dashboard to review the details of the insurance plan you have purchased.

You can view the details of your purchased policy on the dashboard, as shown below.

You can also check all your coverage details here, so you’re all set!

Easily check your insurance cost based on your travel plan!

Conclusion: SafetyWing Is Cost-Effective and Offers Strong Coverage

SafetyWing is one of the best options for travelers thanks to its affordable pricing and well-balanced coverage.

Starting at just $56.28 per month (excluding U.S. coverage), it includes benefits such as medical care, lost baggage protection, flight delay compensation, and trip interruption coverage—features that many competitors do not provide at this price point.

Below is the monthly (4-week) fee for SafetyWing Nomad Insurance.

| Excluding the USA | Including the USA | |

|---|---|---|

| 10-39 years | $56.28 | $104.44 |

| 40-49 years | $92.40 | $171.92 |

| 50-59 years | $145.04 | $282.80 |

| 60-69 years | $196.84 | $386.12 |

For the monthly fee shown above, you can receive up to $250,000 in medical coverage.

Insurance may feel unnecessary if you never get injured, sick, or involved in an accident while abroad. However, having proper coverage is essential for peace of mind and financial protection in case of an emergency.

If you’re looking for an affordable plan with broad coverage, SafetyWing remains one of the best options for global travelers.

Easily check your insurance cost based on your travel plan!