Schengen Travel Insurance Requirements Explained: Entry Rules and Medical Costs

Are you planning a trip to Europe?

If you are traveling to Schengen countries, having travel insurance is very important.

Many travelers think only about medical coverage. However, in some cases, travel insurance is treated as part of the entry requirements.

- You may be denied entry if you cannot show required documents at immigration

- Lost luggage can lead to unexpected expenses

- Medical treatment for illness or injury can be very expensive and must be paid in full

On this page, we explain why travel insurance is especially important in the Schengen Area.

We also share real examples of medical costs you may face if you get sick or injured while traveling.

*Many travelers believe credit card travel insurance is enough, but this mistake can lead to serious problems abroad.

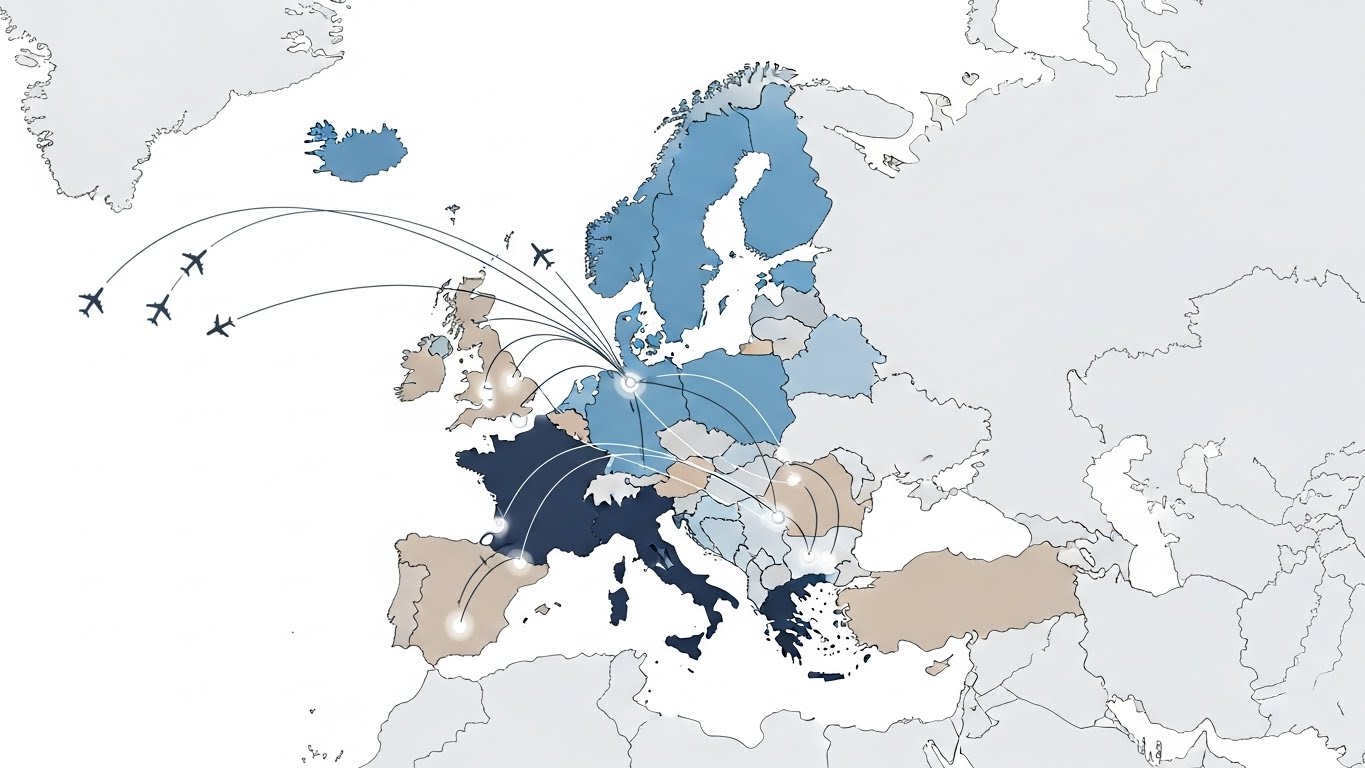

What Is the Schengen Area?

The Schengen Area is an agreement that allows free movement between several European countries by removing border checks.

In most cases, passport control is not required when traveling between Schengen countries.

Once you enter one Schengen country, you can travel to other member countries as easily as moving within the same country.

As of 2026, the Schengen Area includes a total of 29 countries.

EU member countries

: Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden

Non-EU member countries

: Iceland, Liechtenstein, Norway, Switzerland

Under the Schengen Agreement, border rules are shared, making travel within the area simple and smooth.

However, for travelers entering from outside the Schengen Area, common entry requirements apply.

These requirements include checks on the purpose and length of stay, as well as the requirement to have travel insurance.

In other words, the Schengen Area allows free movement within the region, but travelers entering from outside must meet certain conditions before they are allowed to enter.

Is Travel Insurance Mandatory for the Schengen Area?

In the Schengen Area, travel insurance is an official requirement when applying for a short-stay visa.

Even travelers from visa-exempt countries may be asked to show proof of travel insurance during immigration checks.

This is because the Schengen Area allows free movement between member countries, while travelers entering from outside the region are assessed under common entry standards.

As part of this assessment, immigration officers may check whether a traveler is properly prepared for their stay, including whether they have travel insurance.

In particular, immigration checks tend to be more careful in the following situations:

- You plan to travel through multiple Schengen countries

- Your return date is not fixed, or you only have a one-way ticket

- You are staying as a digital nomad or remote worker

- Your stay is relatively long or may be extended

In particular, travelers entering the Schengen Area with a one-way ticket are more likely to be suspected of long-term stay or illegal stay.

As a result, immigration officers may closely check your living arrangements and how well you are prepared for your stay.

As part of this process, they may also check whether you have travel insurance.

If you cannot show proof of travel insurance at immigration, you may be asked to provide additional explanations, or your entry may be assessed under special conditions.

Depending on the situation, you may be required to purchase travel insurance on the spot.

If entry is denied, this record may remain in your passport or immigration records and could affect your future travel to Europe.

For these reasons, travel insurance is not only a way to prepare for medical expenses.

It is also a necessary step to ensure smooth entry and a safe, worry-free stay in the Schengen Area.

Average Medical Costs for Tourists in Schengen Countries

In many Schengen countries, tourists are not covered by the public healthcare system. If you visit a hospital or clinic, you usually have to pay the full cost yourself.

This rule applies not only to short-term tourists, but also to travelers who enter under visa-free arrangements. Because of this, medical treatment can be much more expensive than expected, even for minor illnesses or injuries.

Below are examples of the typical medical costs that tourists may need to pay in major Schengen countries.

| Country | Emergency Room Visit | Hospital Stay (1 night) | Fracture/Minor Sugery |

|---|---|---|---|

| France🇫🇷 | €150-300 | €800-1,500 | €2,000-5,000 |

| Italy🇮🇹 | €200-400 | €1,000-2,000 | €3,000-6,000 |

| Spain🇪🇸 | €120-250 | €700-1,300 | €2,500-5,000 |

| Netherlands🇳🇱 | €200-350 | €1,200-2,000 | €3,000-6,000 |

| Greece🇬🇷 | €100-200 | €600-1,200 | €2,000-4,000 |

| Switzeriand🇨🇭 | €300-600 | €1,500-3,000 | €4,000-8,000 |

As you can see, even minor health problems can result in medical bills of several hundred euros.

If hospitalization or surgery is required, costs can easily reach several thousand euros.

For real examples of high medical expenses and detailed healthcare information by country, please refer to the country-specific guides below.

- France : Traveling to France Without Insurance?

- Italy: Why Italy Travel Insurance Matters?

- Spain: Do You Need Travel Insurance?

- Netherlands: High Medical Costs and What Travelers Should Know?

- Greece: Why Travel Requires Insurance?

- Switzerland: Should You Get Travel Insurance?

Does Credit Card Travel Insurance Meet Schengen Requirements?

Credit card travel insurance is convenient, but it does not always meet the requirements for travel in the Schengen Area.

This is not only because of the coverage itself, but also because the conditions for activation and the way proof is provided can be complicated.

In particular, problems are more likely to occur when travelers rely only on credit card insurance for long-term stays or multi-country trips in Europe.

1. Coverage Amount May Not Meet the Requirements

In the Schengen Area, travel insurance may be required to cover medical expenses and repatriation costs up to a certain amount.

Some credit cards offer high coverage, but the actual limits vary depending on the card type, issuing country, and insurance design. In some cases, the required amount is not met.

- Does the medical coverage limit meet the required amount?

- Are repatriation and emergency transport included?

- Is there a deductible or out-of-pocket cost?

2. Coverage Period Is Often Too Short

Many credit card insurance plans are only valid for a limited number of days from the start of your trip.

This makes them unsuitable for long stays.

Even for trips around Europe, coverage may expire as the number of days since departure increases.

- How many days is the insurance valid from the trip start date?

- Does coverage change when you cross borders or temporarily return home?

3. Strict Conditions May Make the Insurance Unusable

Some credit card insurance plans only apply under specific conditions.

For example, many cards require you to pay for flights or tours with the same card.

If you book flights or hotels on your own using another payment method, the insurance may not apply.

- Is the insurance automatic or conditional?

- Which payments are required to activate coverage?

- What are the conditions for family coverage?

4. Proof of Insurance May Not Be Easy to Show

For immigration checks or visa-related procedures, you may be asked to show proof of insurance that covers your entire stay.

With credit card insurance, issuing an insurance certificate can take time, and an English version may not be immediately available.

Even if the coverage meets the requirements, you may be treated as uninsured if you cannot show proper proof at immigration.

- Can you get an English insurance certificate online immediately?

- Are the coverage amount and period clearly stated?

- Are medical treatment and repatriation clearly listed?

As shown above, credit card travel insurance is not a complete solution.

Since insurance claims are a cost for card issuers, it is natural that the conditions for using this insurance are becoming stricter.

To avoid these problems, having proper travel insurance is strongly recommended.

For example, for short trips of a few days to one week, SafetyWing offers medical insurance coverage of up to $250,000 for a premium of $10.05.

Summary

When traveling to the Schengen Area, travel insurance is not just an optional extra.

It is important not only for medical expenses, but also for making your entire trip smoother, including immigration checks.

In reality, travelers who do not have travel insurance, or whose insurance does not meet the requirements, may face unexpected problems.

- You may be denied entry if you cannot provide required documents at immigration.

- Lost luggage can cause unexpected expenses.

- Medical treatment for illness or injury can be very expensive and must be paid in full.

These are not rare situations.

They are realistic risks for both tourists and long-term visitors traveling in the Schengen Area.

By having proper travel insurance, you can reduce stress at immigration and during your stay.

This allows you to focus on enjoying your trip or your time abroad, which is the real purpose of your journey.