Travel Insurance for Canada Trips: What You Must Know

Canada is a popular destination for travel, study, and working holidays, but medical care can be very expensive.

Without insurance, even a basic hospital visit may lead to a heavy financial burden.

Here are some real examples of medical expenses reported by travelers in Canada.

Severe headaches, vomiting, and abdominal pain occurred while staying at a homestay. The traveler was diagnosed with peritonitis, underwent surgery, and stayed in the hospital for 10 days.

Total cost: $83,500

A fever of 40°C (104°F) persisted for 10 days. After visiting a doctor, the traveler was diagnosed with pneumonia and hospitalized for 10 days.

Total cost: $21,000

A traveler experienced fever and difficulty breathing. They were diagnosed with pneumonia, underwent surgery, and spent 21 days in the hospital.

Total cost: $85,600

Below are some overseas travel insurance services that offer comprehensive coverage at a good price.

You can apply for these insurance services online.

This page explains why having medical insurance is essential for your stay in Canada and introduces recommended travel insurance plans that you can easily purchase online.

- Canada’s Healthcare System and Medical Costs

- Is Medical Insurance Required During Your Stay in Canada?

- Is Insurance Required for a Working Holiday in Canada?

- Examples of High Medical Expenses in Canada

- 1. Diverticulitis – 5 Days of Hospitalization

- 2. Subdural Hematoma & Scapula Fracture – 27 Days of Hospitalization

- 3. Cholecystitis – 6 Days of Hospitalization & Surgery

- 4. Acetabular Fracture – 13 Days of Hospitalization

- 5. Skull & Jaw Fracture – 3 Days of Hospitalization

- 6. Angina – 11 Days of Hospitalization & Surgery

- 7. Encephalitis – 19 Days of Hospitalization & Medical Plane Transport

- A Must-Check Before Traveling to Canada! 3 Affordable Medical Insurance Options

Canada’s Healthcare System and Medical Costs

Through the public system called Medicare, Canadian citizens and permanent residents can receive most medical services at no cost.

However, this public insurance does not apply to foreign travelers or working holiday visitors.

Below are examples of typical medical expenses for travelers receiving treatment at public medical facilities in Canada.

| Item | Estimated Medical Costs |

|---|---|

| General consultation | $100–$200 |

| Prescription medication | $15–$110 |

| Dental treatment (cavity) | $100–$300 |

| Ambulance service | $300–$800 |

| Hospitalization | Private room: $2,000–$3,000 CU: $3,700–$7,500 |

Medical care in Canada can be extremely expensive, similar to the United States.

Even a basic consultation may cost several hundred dollars, and emergency surgeries or hospital stays can easily result in medical bills ranging from thousands to tens of thousands of dollars.

Is Medical Insurance Required During Your Stay in Canada?

Some countries, especially those in the Schengen Area, require travelers to show proof of medical insurance upon entry.

For example, in the Czech Republic, medical insurance is mandatory. Travelers must carry proof of insurance during their stay, and failure to present it may result in fines or denial of entry.

» Which Countries Require Travel Insurance to Enter?

Canada, however, does not require medical insurance for short-term travelers.

*That said, medical costs in Canada are very high, similar to the United States. Without insurance, even a minor illness or injury can lead to unexpectedly large medical bills.

To avoid high out-of-pocket expenses and travel with peace of mind, it is strongly recommended to purchase medical insurance before your trip.

Is Insurance Required for a Working Holiday in Canada?

Yes. If you are entering Canada on a working holiday visa, medical insurance is mandatory.

To receive the visa, you must have valid medical insurance that covers your entire stay in Canada. You may also be asked to provide proof of insurance during the visa application or upon arrival.

Your insurance must:

- Cover the full duration of your stay

- Include medical treatment and emergency medical transportation

Most standard travel insurance plans meet these requirements as long as you set the correct travel period. However, credit card insurance is not accepted for working holiday visas.

The following three insurance providers introduced in this article are also suitable for working holiday visa applications:

These plans offer strong medical coverage and are easy to purchase online, making them ideal for long-term stays in Canada.

Examples of High Medical Expenses in Canada

If you become sick or injured in Canada, medical bills can be far higher than expected.

Here are real cases showing how costly treatment can be without insurance.

1. Diverticulitis – 5 Days of Hospitalization

The traveler experienced sudden, severe abdominal pain and was transported to the hospital by ambulance. Tests revealed diverticulitis, requiring several days of monitoring, IV treatment, and medication.

Total cost: $22,000

2. Subdural Hematoma & Scapula Fracture – 27 Days of Hospitalization

After falling while cycling, the traveler was rushed to the hospital and diagnosed with a subdural hematoma and a fractured scapula. Surgery was required, followed by nearly a month of hospitalization and rehabilitation.

Total cost: $26,600

3. Cholecystitis – 6 Days of Hospitalization & Surgery

The traveler developed intense abdominal pain and shaking fever, and an ambulance brought them to the ER. Doctors diagnosed acute cholecystitis, which required emergency surgery and a week of hospitalization.

Total cost: $29,900

4. Acetabular Fracture – 13 Days of Hospitalization

After falling from a horse during an outdoor activity, the traveler was taken to the hospital and diagnosed with an acetabular (hip socket) fracture. Surgery and long-term inpatient care were necessary, and medical transport home required a nurse escort.

Total cost: $58,300

5. Skull & Jaw Fracture – 3 Days of Hospitalization

The traveler fainted due to anemia while sightseeing, fell, and hit their face on the ground. They were diagnosed with skull and jaw fractures, requiring emergency surgery and hospitalization.

Total cost: $25,600

6. Angina – 11 Days of Hospitalization & Surgery

During a homestay, the traveler experienced sudden chest pain and was taken by ambulance to the hospital. They were diagnosed with angina and required immediate surgical treatment followed by more than a week of hospitalization.

Total cost: $44,700

7. Encephalitis – 19 Days of Hospitalization & Medical Plane Transport

The traveler suddenly fell ill at their homestay and was transported by ambulance, where they were diagnosed with encephalitis. Their condition required intensive treatment, nearly three weeks of hospitalization, and ultimately a chartered medical flight home with a doctor and nurse escort.

Total cost: $260,000

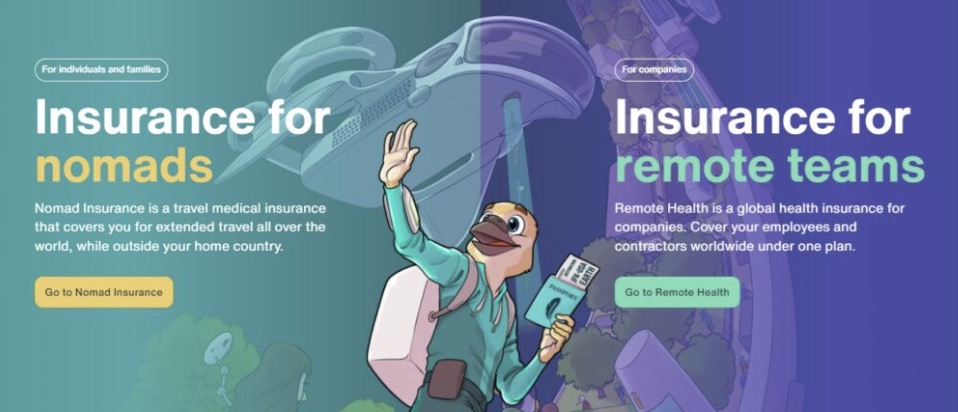

A Must-Check Before Traveling to Canada! 3 Affordable Medical Insurance Options

If you need medical treatment during your stay in Canada due to an unexpected illness or accident, the medical bills can be extremely high.

To avoid these financial risks, it is essential to purchase medical insurance before your trip.

Here are three cost-effective medical insurance services that you can easily sign up for online:

- Safety Wing

: A budget-friendly insurance option that allows same-day enrollment and instant coverage, even if you are already abroad. - World Nomads

: A comprehensive plan that covers medical expenses, emergency transport, and even theft, making it suitable for a wide range of travelers. - Heymondo

: Offers flexible plans designed for long-term travelers, with medical coverage options of up to $10,000,000.

These three medical insurance services provide strong coverage at an affordable price, helping you travel in Canada with confidence and peace of mind.

SafetyWing

Safety Wing is the perfect choice for travelers to Canada, offering comprehensive, affordable coverage.

If you’re already in Canada, you can join immediately.

- Monthly premium: $56.28

- Flexible coverage starting from as little as 5 days

- No waiting period when enrolling from overseas

- 24/7 live chat support for immediate assistance

- Coverage includes flight delays and lost baggage

- Simple online process to get a quote and register within minutes

The detailed insurance coverage is listed below.

| Insurance Details | Insurance Limit |

|---|---|

| Medical Insurance | $250,000 |

| Emergency Dental Care | $1,000 |

| Emergency Transportation | $100,000 |

| Medical repatriation | $5,000 |

| Emergency return to your country | $5,000 |

| Lost Baggage | $3,000 |

| Flight delays | $200 |

| Theft of passports | $100 |

| Car Accident | $250,000 |

| Interruption of travel (return to your country) | $250,000 |

| At the time of death | $20,000 |

Safety Wing is an overseas travel insurance plan that offers comprehensive medical coverage of up to $250,000 at an affordable price.

ou can also adjust the coverage period to match the exact length of your trip, making it easy to choose a plan that fits your travel style and budget.

Check the official Safety Wing website now to get a personalized quote!

World Nomads

World Nomads provides very comprehensive coverage with high benefit limits, making it an excellent choice for travelers who plan to enjoy outdoor activities or adventure experiences during their stay in Canada.

- Insurance premiums vary depending on your destination

(4-week plan that includes coverage in the U.S. costs $265.07) - Medical coverage limit of $5,000,000, with an option for unlimited coverage

- Includes protection for flight delays and lost baggage

- 24/7 customer support available by phone or email

The detailed insurance coverage is as follows.

| Insurance Details | Insurance Limit |

|---|---|

| Medical Insurance | $5,000,000 |

| Emergency Dental Care | $300 |

| Medical Transportation and Repatriation | $5,000,000 |

| Medical repatriation | $5,000 |

| Emergency return to your country | $5,000 |

| Baggage coverage | $2,500 |

| Flight delays | $500 |

| Interruption of travel (return to your country) | $3,500 |

| At the time of death | $15,000 |

World Nomads is highly recommended for travelers visiting countries with very high medical costs, such as the U.S. and Canada.

It provides medical coverage of up to $5 million or even unlimited amounts, offering strong protection in case of emergencies.

Since premiums vary depending on your destination, you can easily check the exact cost for your trip on the World Nomads website.

Heymondo

Heymondo is an excellent, cost-effective travel insurance option for those planning a long-term stay in Canada.

By choosing the three-month plan, you can lower your monthly premium while still being fully prepared for Canada’s high medical expenses.

- Cost-effective three-month plan for long-term stays

- Premiums vary depending on your destination country

- Medical coverage limit of $5,000,000 (or up to $10,000,000)

- Includes coverage for flight delays and lost baggage

- 24/7 customer support by phone or email

The detailed coverage information is as follows:

| Insurance Details | Insurance Limit |

|---|---|

| Medical Insurance | $5,000,000 |

| Emergency Dental Care | $300 |

| Extended Overnight Expenses | $1,800 |

| Emergency Transportation | $5,000,000 |

| Baggage coverage | $1,700 |

| Flight delays | $450 |

| Interruption of travel (return to your country) | $3,500 |

| At the time of death | $100,000 |

Heymondo offers multiple insurance plans, including the popular Travel Insurance Top plan with comprehensive coverage.

Depending on the plan, medical coverage can go up to $10 million, providing strong protection against high overseas medical costs.

Check the Heymondo website for a quick quote and choose the best plan for your trip.