Why Greece Travel Requires Insurance: High Medical Costs Explained

A trip to Greece is unforgettable.

From the blue-and-white scenery of Santorini to the ancient ruins of the Acropolis and delicious Mediterranean cuisine, Greece offers experiences that amaze every traveler.

However, accidents and illnesses can happen during your trip.

Here are some common incidents travelers may face in Greece:

- Food poisoning from seafood or Mediterranean dishes

→ Consultation: €50–€200

→ Hospitalization: €700–€2,000 - Heatstroke or dehydration while sightseeing

→ Emergency treatment: €100–€300

→ IV therapy: €200–€500 - Fractures from slips or falls at archaeological sites

→ X-ray and treatment: €1,000–€5,000

If you don’t have medical insurance during your stay, all of these costs must be paid out of pocket. Hospital stays and surgeries, in particular, can reach several thousand euros.

You can easily sign up for the following travel insurance plans online, all offering comprehensive protection.

Prepare well and enjoy a safe, memorable journey to Greece!

Healthcare Standards and Medical Costs in Greece

Greece offers a high level of healthcare, with well-equipped public and private medical facilities available throughout major cities and popular tourist destinations.

However, healthcare in Greece is not free for visitors.

Since public health insurance does not apply to travelers, all medical expenses must be paid out of pocket. Below is an overview of typical medical costs in Greece:

| Item | Estimated Medical Costs |

|---|---|

| General Consultation | €40~€100 |

| Emergency Visit | €100-€250 |

| Prescription | €10~€50 |

| Ambulance Use | Base fee (€70) + Distance fee (€2/km) |

| Hospitalization (per day) | Private Room: €600-€10,00 ICU: €1,500~€2,500 |

For instance, breaking a bone while sightseeing could require X-rays, treatment, and several days of hospitalization, easily totaling several thousand euros.

Is Travel Insurance Mandatory When Entering or Staying in Greece?

Some countries require travelers to show proof of medical insurance upon entry.

For example, in the Czech Republic, visitors must present valid medical insurance when entering the country and carry the certificate with their passport throughout their stay. Failure to do so may result in fines.

» Which Countries Require Travel Insurance to Enter?

In contrast, Greece does not currently require travel insurance for entry or short-term stays.

However, there are several important reasons why purchasing travel insurance before your trip to Greece is strongly recommended.

Schengen Visa Requirement for Some Travelers

If you are from a country that requires a Schengen visa, you may need to show proof of travel insurance with at least €30,000 in medical coverage when entering Greece.

This makes having valid insurance mandatory for visa applicants.

High Medical Costs in Case of an Emergency

Foreign travelers are not covered by Greece’s public health insurance system. This means you must pay the full cost of treatment if you become sick or injured.

Emergency consultations, ambulance services, and hospitalization can cost hundreds to several thousand euros, leading to unexpected financial burdens.

Examples of High Medical Costs During a Trip to Greece

If you get injured or fall ill while traveling in Greece, medical expenses can become much higher than expected.

Here are several cases where travelers faced significant costs.

Case 01: Fracture After Falling at the Acropolis

If you slip on uneven stone steps at historical sites like the Acropolis and suffer a fracture, the following expenses may occur:

- Emergency transportation: €300

- Surgery costs: €10,000

- Hospitalization (5 days): €4,000

- Rehabilitation costs: €1,200

Total cost : €15,500

*If the accident occurs on remote islands or mountainous areas, helicopter transport may be required at an additional cost.

Case 02: Emergency Hospitalization Due to Seafood Food Poisoning

Greece is famous for fresh seafood, but food poisoning can lead to unexpected medical bills. Here is an example of the costs involved:

- Emergency transportation: €250

- Hospitalization (3 days): €2,200

- Consultation and testing: €700

- Treatment and medication: €600

Total cost: €3,750

*Severe cases may require a longer hospital stay, which increases the total cost.

Case 03: Shoulder Fracture from a Bicycle Accident

Cycling is a popular activity in Greece, but accidents can occur due to narrow roads or unexpected traffic. Below is an example of the expenses:

- Emergency transportation: €200

- Surgery costs: €8,500

- Hospitalization (4 days): €3,000

- Rehabilitation costs: €1,100

Total cost : €12,800

*Always stay alert to road and traffic conditions when cycling in tourist areas.

Check Now: Travel Insurance You Can Apply for Online

Travel insurance that you can apply for online and submit claims digitally is extremely convenient for international travelers.

All of the insurance services listed here offer full online procedures and provide comprehensive coverage.

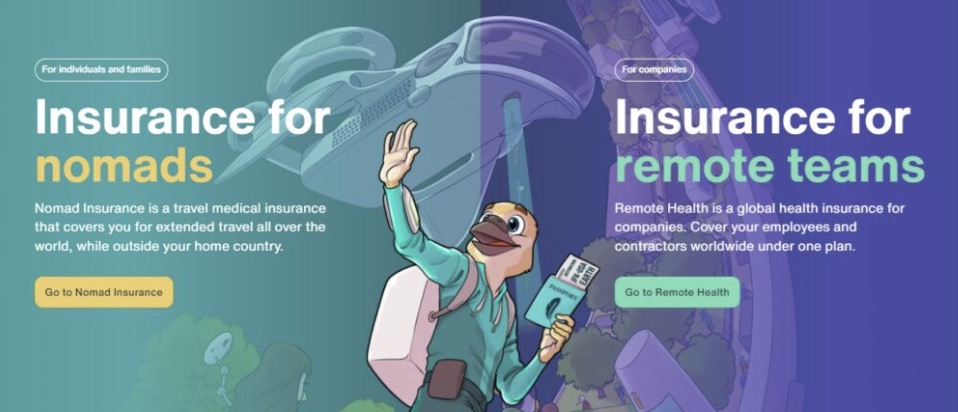

- SafetyWing

: A budget-friendly insurance plan that you can purchase online on the same day. You can also enroll from abroad with no waiting period. - World Nomads

: Provides broad protection, including medical coverage and theft compensation. A reliable choice for travelers who want strong overall coverage. - Heymondo

: Offers plans designed for long-term stays, with options that include medical coverage of up to $10,000,000.

To enjoy a safe and worry-free trip to Greece, consider signing up for one of these insurance plans.

SafetyWing

Safety Wing is an international travel insurance plan that offers up to $250,000 in medical coverage for a monthly premium of $56.28.

Even if you are already in Greece, you can sign up from abroad with no waiting period.

- Monthly Premium: $56.28

- Coverage starts as soon as 5 days

- No waiting period for international enrollments

- 24/7 live chat support

- Coverage for flight delays and lost baggage

- Smooth online process, from quote to enrollment

See below for specific coverage details.

| Insurance Details | Insurance Limit |

|---|---|

| Medical Insurance | $250,000 |

| Emergency Dental Care | $1,000 |

| Emergency Transportation | $100,000 |

| Medical repatriation | $5,000 |

| Emergency return to your country | $5,000 |

| Lost Baggage | $3,000 |

| Flight delays | $200 |

| Theft of passports | $100 |

| Car Accident | $250,000 |

| Interruption of travel (return to your country) | $250,000 |

| At the time of death | $20,000 |

You can adjust the coverage period to fit your travel schedule, allowing you to use the plan efficiently and avoid unnecessary costs.

Start by getting a quick quote on the SafetyWing website to see how much your premium will cost.

World Nomads

World Nomads offers medical coverage and coverage against theft, including pickpocketing.

Easily apply online and customize your plan to fit your destination and length of stay.

- Premiums vary depending on the country you visit.

(Ex, a 4-week plan including the U.S. costs $265.07.) - Medical coverage limits are $5,000,000 or unlimited.

- Flight delays and lost baggage are also covered.

- 24/7 customer support via phone and email.

Specific coverage details are as follows:

| Insurance Details | Insurance Limit |

|---|---|

| Medical Insurance | $5,000,000 |

| Emergency Dental Care | $300 |

| Medical Transportation and Repatriation | $5,000,000 |

| Medical repatriation | $5,000 |

| Emergency return to your country | $5,000 |

| Baggage coverage | $2,500 |

| Flight delays | $500 |

| Interruption of travel (return to your country) | $3,500 |

| At the time of death | $15,000 |

World Nomads has a higher insurance premium at $215.38 for 4 weeks, but it provides strong protection with coverage up to $5,000,000, and even an unlimited plan is available.

You can easily check your estimated premium based on your travel schedule by visiting the World Nomads website.

Heymondo

For travelers planning a long-term stay in Europe, including Greece, Heymondo is a highly recommended option thanks to its strong cost performance.

By choosing the 3-month plan, you can reduce your monthly premium while still having access to medical coverage of up to $10,000,000.

- Cost-effective 3-month plan ideal for long-term travel

- Premiums vary depending on your destination country

- Medical coverage limit of $5,000,000 (or $10,000,000 for select plans)

- Coverage for flight delays and lost baggage

- 24/7 support via phone and email

Specific insurance coverage is as follows:

| Insurance Details | Insurance Limit |

|---|---|

| Medical Insurance | $5,000,000 |

| Emergency Dental Care | $300 |

| Extended Overnight Expenses | $1,800 |

| Emergency Transportation | $5,000,000 |

| Baggage coverage | $1,700 |

| Flight delays | $450 |

| Interruption of travel (return to your country) | $3,500 |

| At the time of death | $100,000 |

The information above refers to the standard plan (Travel Insurance Top).

Heymondo also offers several other insurance plans to choose from. Premiums vary depending on the plan, and some options include medical coverage of up to $10,000,000.

For more details about pricing, visit the Heymondo website and get a quick online estimate.