Is Travel Insurance Necessary for Singapore? Real Medical Cost Examples

Medical expenses in Singapore are among the highest in Asia, making it essential for travelers to prepare for unexpected healthcare costs.

If you plan to rely on credit card insurance, be sure to check the terms carefully, as coverage may not be sufficient for local medical fees.

Below are real examples of medical cases that resulted in high medical bills.

Shortness of breath and severe back pain. Diagnosed with uterine fibroids. Hospitalized for 3 days and underwent surgery.

Severe headache and transported by ambulance. Diagnosed with subarachnoid hemorrhage. Hospitalized for 26 days with surgery. Nurse-assisted medical transport included.

Fell down the stairs and hit the elbow hard. Diagnosed with ligament rupture. Hospitalized for 9 days and underwent surgery.

These cases highlight how expensive medical treatment in Singapore can be.

To avoid heavy out-of-pocket expenses, purchasing travel insurance before your trip is strongly recommended. The following insurance options can be applied for online and offer comprehensive protection for travelers.

This page explains Singapore’s medical system, typical healthcare costs, and key points you should know before your visit.

Singapore’s Healthcare System Is Largely Private

In Singapore, the healthcare system is largely private, so medical costs differ greatly from one facility to another.

*Compared with many other countries, medical care in Singapore has a stronger commercial aspect.

Many doctors expect foreign visitors to have travel insurance. As a result, even simple treatment such as a consultation and medicine for a cold often leads to a high bill, for example around $300.

Government hospitals are generally more affordable. Even a night-time visit to the emergency room at a public hospital often costs around $100.

However, at government hospitals, waiting times become very long when a case is judged as non-urgent.

Examples of High Medical Bills in Singapore

Medical costs in Singapore are significantly higher than in many other countries.

For example, treatment for a common cold can cost around $400, and receiving stitches for a cut may cost as much as $3,000.

Hospitalization also tends to be very expensive, with total costs often reaching $13,000 or more.

Below are some specific examples of high medical expenses reported by travelers.

1. Hospitalized for 3 days and underwent surgery for uterine fibroids

While traveling in Singapore, a traveler experienced severe back pain. After visiting a hospital, they were diagnosed with uterine fibroids.

They were hospitalized for 3 days and underwent surgery.

Total cost: $24,700

2. Hospitalized for 26 days due to subarachnoid hemorrhage

During a trip, a traveler suffered intense headaches and was taken to the hospital by ambulance.

They were diagnosed with a subarachnoid hemorrhage and required surgery followed by 26 days of hospitalization.

Total cost: $55,000

3. Hospitalized for 9 days and underwent surgery for a ligament rupture

A traveler fell down the stairs and severely injured their elbow.

At the hospital, they were diagnosed with a ligament rupture and were hospitalized for 9 days, including surgery.

Total cost: $48,000

4. Hospitalized for 7 days due to gastritis

During a cruise stop in Singapore, a traveler developed vomiting and hematemesis (vomiting blood).

After being transported to a hospital, they were diagnosed with gastritis and required 7 days of hospitalization.

Total cost: $44,000

5. Hospitalized for 14 days due to pyelonephritis

While visiting Singapore, a traveler developed a fever and went to the hospital.

They were diagnosed with pyelonephritis and required 14 days of hospitalization.

Total cost: $33,800

Top 3 Travel Insurance Options for High Medical Bills in Singapore

If you experience an unexpected accident or illness during your trip to Singapore, medical costs can be extremely expensive.

To avoid paying these high expenses out of pocket, it is essential to purchase travel insurance before you travel.

Below are three recommended travel insurance providers that you can easily apply for online.

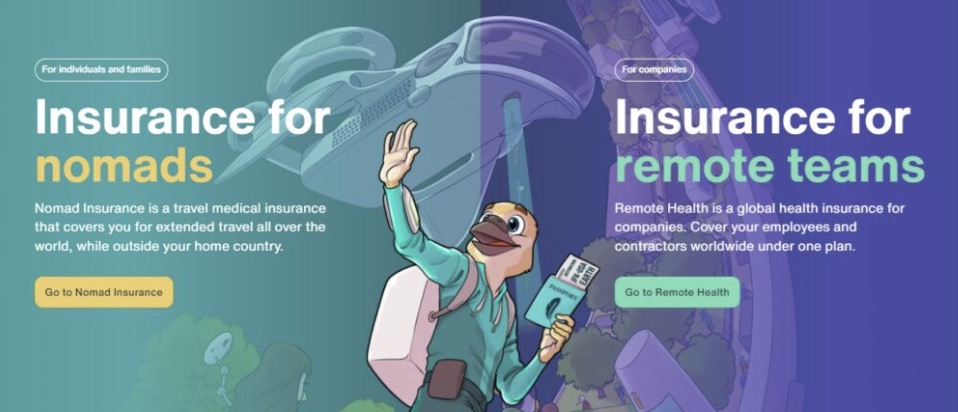

- SafetyWing

: A cost-effective travel insurance plan that can be purchased online on the same day. Travelers can also enroll from abroad with no waiting period. - World Nomads

: Offers comprehensive coverage, including medical insurance, adventure activity coverage, and protection against theft. - Heymondo

: Provides plans tailored for long-term travelers, with medical coverage options of up to $10,000,000.

To enjoy your trip to Singapore with peace of mind, consider enrolling in one of these travel insurance plans.

SafetyWing

SafetyWing offers excellent cost performance and comprehensive travel insurance coverage. You can easily apply online, even if you are already abroad.

- Monthly premium starts at $56.28

- Minimum coverage period is 5 days

- Instant enrollment with no waiting period, even when applying from overseas

- 24/7 live chat support

- Coverage for flight delays and lost baggage

The detailed insurance coverage is outlined below:

| Insurance Details | Insurance Limit |

|---|---|

| Medical Insurance | $250,000 |

| Emergency Dental Care | $1,000 |

| Emergency Transportation | $100,000 |

| Medical repatriation | $5,000 |

| Emergency return to your country | $5,000 |

| Lost Baggage | $3,000 |

| Flight delays | $200 |

| Theft of passports | $100 |

| Car Accident | $250,000 |

| Interruption of travel (return to your country) | $250,000 |

| At the time of death | $20,000 |

SafetyWing is a travel insurance option known for its excellent cost performance.

It offers medical coverage of up to $250,000, with premiums starting at $56.28 per month. You can also flexibly adjust the coverage period to match the exact length of your trip.

You can easily check your insurance estimate on the official SafetyWing website.

World Nomads

World Nomads is a popular travel insurance option among freelancers and digital nomads who work overseas. It offers extensive coverage for many travel situations, making it a reliable and flexible choice.

- Premiums vary depending on your destination

(Example: $265.07 for a 4-week plan that includes the US) - Medical coverage limit of $5,000,000 with unlimited coverage available in some plans

- Protection for flight delays and lost baggage

- 24/7 customer support by phone or email

The detailed insurance coverage is listed below:

| Insurance Details | Insurance Limit |

|---|---|

| Medical Insurance | $5,000,000 |

| Emergency Dental Care | $300 |

| Medical Transportation and Repatriation | $5,000,000 |

| Medical repatriation | $5,000 |

| Emergency return to your country | $5,000 |

| Baggage coverage | $2,500 |

| Flight delays | $500 |

| Interruption of travel (return to your country) | $3,500 |

| At the time of death | $15,000 |

World Nomads is particularly suitable for travel to high-cost countries such as the US and Canada.

It offers medical coverage of up to $5,000,000 and some plans even provide unlimited coverage, making it an appealing option for travelers who want strong, comprehensive protection.

Premiums vary depending on the country you plan to visit.

You can easily check estimated costs based on your travel details on the official World Nomads website.

Heymondo

Heymondo offers high-value travel insurance designed for long-term travelers.

Choosing a 3-month plan allows you to reduce your monthly premium while still maintaining strong coverage.

- Cost-effective 3-month plans ideal for extended stays

- Premiums vary depending on your travel destination

- Medical coverage limit of $5,000,000 or up to $10,000,000 with certain plans

- Coverage for flight delays and lost baggage

- 24/7 customer support by phone or email

The detailed insurance coverage is listed below:

| Insurance Details | Insurance Limit |

|---|---|

| Medical Insurance | $5,000,000 |

| Emergency Dental Care | $300 |

| Extended Overnight Expenses | $1,800 |

| Emergency Transportation | $5,000,000 |

| Baggage coverage | $1,700 |

| Flight delays | $450 |

| Interruption of travel (return to your country) | $3,500 |

| At the time of death | $100,000 |

Heymondo offers several insurance plans, and the information above outlines the standard plan known as Travel Insurance Top.

While premiums vary by plan, you can also select a higher-tier option that provides medical coverage of up to $10,000,000.

You can easily check detailed premium estimates on the official Heymondo website.

Thank you for reading to the end!

If you are searching for the best travel insurance options, please check the page below.

We have selected popular insurance providers and explained their features and benefits in detail, making it easier for you to choose the plan that best fits your needs.